On October 10, 2023, PaidHR launched the Earned Wage Access (EWA) product to improve workers’ lives. The singular question, “Why should employees wait until payday to access their earned money?” propelled us to build a product that has tested the hands of the clock.

In just three days, we got 25 approvals, and in ten days, we achieved a +257.14% increase in mobile app installations. It was a feat we did not take for granted and a solid nod that we were building something the people needed. By 2024, it was a 1600% growth in EWA.

Numbers are boring, yes, but they tell a story and Earned Wage Access by PaidHR’s story is one of making the lives of workers who use PaidHR better.

We have heard several testimonials of how EWA has come through for people during times of emergency.

While we are indeed happy to make more people not be caught in the net of debt, there are still people who do not understand the product or how it works, and this post is going to explain all you need to know about the product for employers, HR professionals and employees alike.

How much can I access before payday?

By default, PaidHR allows you to access 100% of your daily earnings before the end of the month. Your employer can also adjust the percentage if needed.

For example, if you earn ₦300,000 per month, PaidHR breaks that down to ₦10,000 per workday. If you’ve worked 10 days, you’ve earned ₦100,000, and you can access all of that money.

How quickly can I get my money?

Immediately.

Once you make a withdrawal from your EWA balance through the mobile app, the money hits your PaidHR wallet instantly. No approvals, no waiting, no back-and-forth.

How often can I access my earned wages?

As often as you need to, within your available balance.

We don’t limit the number of withdrawals you can make in a month. Just remember: the more you access, the less you’ll receive on payday (since it’s already been sent to you earlier).

Will this disrupt payroll processes?

Not at all.

Your employer doesn’t need to pause, tweak, or manually adjust anything.

Once payroll is processed at the end of the month, PaidHR automatically deducts any advances you took and credits you the balance. Everything runs as it normally would.

How does using Earned Wage Access affect my full salary?

It does not reduce your salary; it only splits the timing.

If you have accessed ₦50,000 before payday, you will receive the remaining ₦250,000 when your salary is processed. No surprises.

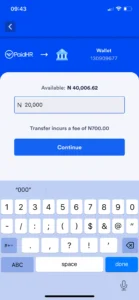

Is there a charge for using Earned Wage Access?

Yes, but it’s important to understand what you’re actually paying for. We charge a small transaction fee of 3.5% on only the amount you withdraw, not your entire salary.

For example, if you withdraw ₦20,000 to handle an emergency car repair, your fee is just ₦700.

We’ve been asked why this transaction fee sometimes seems a lot sometimes and this is because money costs money, but we’re still far more affordable than loan apps, payday lenders, or bank overdrafts. With EWA by PaidHR, you avoid interest, late fees, and awkward borrowing.

Think of it as a tiny cost for convenience, control, and peace of mind, not debt.

Can HR monitor how I use EWA?

Yes, but only at a summary level.

HR can see that you’ve accessed Earned Wage Access during the month, but they’re not notified every time you make a withdrawal.

Earned Wage Access works quietly in the background without disrupting your day-to-day work or singling you out.

Is it safe and compliant?

Absolutely.

Earned Wage Access by PaidHR is designed with security and compliance at its core. We work closely with employers to ensure everything runs within agreed terms, and your data stays safe.

Is this a long-term solution or just a quick fix?

Think of it as a financial safety net, not your daily wallet.

EWA is built for emergencies and one-off expenses; those moments when life throws the unexpected your way. It’s not meant to replace long-term financial planning, but it does help you avoid predatory loans or last-minute panic.

However, for long-term solutions, we have the Loan Marketplace, a space where trusted, regulated financial institutions partner with employers to offer employees fair-rate credit, linked to their payroll.

Can this work for contract or hourly workers?

Yes, it can.

As long as your earnings can be tracked daily or per shift, EWA works just the same. PaidHR simply calculates what you’ve earned so far and makes it available in your Wallet.

Bonus: What makes EWA by PaidHR different?

- It is not a loan or a salary advance.

- You do not pay interest.

- You do not need HR approvals.

- It does not affect payroll.

- You only access what you have earned.

Employers love it because it improves staff wellbeing at zero cost to the company.

Employees love it because it means freedom, dignity, and control.

Smart Employers and HR Teams use PaidHR

With EWA by PaidHR, your money works on your timeline.

No more waiting till payday. No more awkward loan requests. Just access what is already yours when you need it most.

Are you ready to turn on Earned Wage Access but not using PaidHR yet? Book a demo with us or simply get started here. If you are an employee, you can refer your employer or HR with this link.