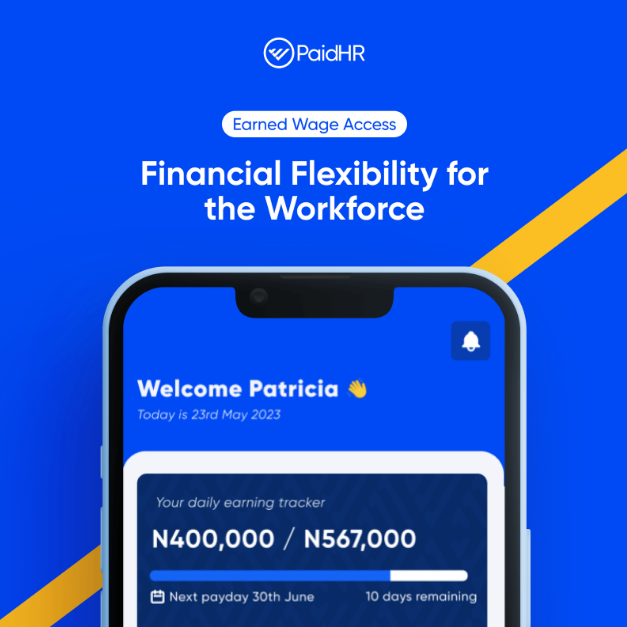

Managing personal finances can be one of the most stressful aspects of life. Traditionally, payroll systems often require employees to wait until the end of the month to receive their wages, which may not always align with their immediate financial needs. This delay can lead to stress and reliance on high-interest loans, creating a cycle of financial insecurity. This is why we created Earned Wage Access (EWA) by PaidHR, a solution that is transforming how employees manage their finances.

What is Earned Wage Access?

Earned Wage Access (EWA) is a service that allows employees to access a portion of their earned wages before their payday, offering greater financial flexibility by enabling them to withdraw money they have already earned at any point during the pay cycle. This money is directly deposited into their PaidHR Wallet. This results in better financial well-being, which can lead to higher fulfilment in the workplace.

Importantly, Earned Wage Access is not a loan, meaning there are no interest rates or hidden fees—just direct access to wages that have already been earned.

How Earned Wage Access by PaidHR Promotes Financial Discipline

Earned Wage Access means different things to different users. To understand how Earned Wage Access has positively impacted its users, let’s consider the stories of two employees.

For Ms Sewa, EWA allows her to manage unexpected bills without headache.

“When I had to pay for a car repair that cost almost double what I budgeted for, I just used EWA to make up the difference. Without it, I would have gone to take a payday loan and I would have paid a really high interest rate”

While for Mr Ejiro, he uses this feature as a key part of his personal financial strategy.

“When I receive my salary, I immediately put it into a safelock,” he explains. “I survive on the interest that’s paid out immediately, and then I use EWA to cover my remaining expenses for the month.”

This method has allowed him to be more disciplined with his money in the following ways:

- Building Wealth: By placing his salary into a high-interest savings account, he is steadily growing his wealth. The interest generated helps supplement his monthly needs, meaning he does not need to touch the principal amount. Over time, this approach contributes to his financial growth.

- Avoiding Debt: With access to his earned wages whenever necessary, he no longer needs to rely on loans to bridge the gap between paydays. This means he avoids accumulating high-interest debt, which can quickly become unmanageable.

- Financial Discipline: The act of immediately depositing his salary into a savings account before spending any of it has fostered better financial habits. He is more mindful of his spending and prioritizes essential needs.

- Staying in Control: Earned Wage Access gives him peace of mind, as he has complete control over his finances. Knowing he can access his earnings as needed allows him to plan for unexpected expenses, giving him confidence and reducing financial stress.

The Benefits of Earned Wage Access for Employers

The benefits of Earned Wage Access are not limited to employees only. For most Organisations, offering Earned Wage Access is a way to support employee financial wellness at zero cost to their business. When employees feel that their employer cares about their well-being and financial security, they are more likely to stay loyal to the company. In fact, research shows that offering financial wellness programs like EWA can reduce turnover and boost employee productivity.

Earned Wage Access is a game-changer in the way employees manage their finances. It empowers individuals to take control of their money, avoid the pitfalls of debt, and build wealth over time. As seen in the testimonials shared, it can help promote financial discipline, providing employees with a clear strategy for saving and spending.

By incorporating EWA into payroll systems, employers are investing not only in the financial well-being of their employees but also in the long-term success of their business. In an era where financial pressures are increasingly prevalent, services like Earned Wage Access are crucial in helping employees navigate their financial challenges and build a more stable future.

Want to get started, Speak to our team about enabling EWA for your business or Refer your employer to use EWA.