For many Nigerian startups, managing payroll seems like a task that can be handled in a spreadsheet or delegated to “someone in finance.” But in reality, payroll is one of the most complex, high-risk responsibilities in a growing company, and it’s often where founders unknowingly bleed money.

Simple payroll errors can trigger hefty compliance fines, confuse team members, and even cause irreparable damage to your startup’s credibility. Among the many mistakes startups make, three stand out as the most frequent and the most costly.

In this post, we’ll explore these major payroll errors and how Nigerian startups can either handle them better manually (with professional help) or automate them with an automated payroll software like PaidHR.

1. Misclassifying Employees and Contractors

As startups scale, they often work with a mix of full-time staff, freelancers, and contractors. The problem? Many founders don’t understand the legal and tax distinctions between these roles, and that mistake can lead to serious compliance violations.

Why it matters:

- Employees are entitled to benefits like pensions, tax remittances, and leave, while contractors aren’t.

- Misclassifying an employee as a contractor (intentionally or by accident) can lead to backdated tax liabilities, penalties, and legal disputes.

- New Nigerian labour regulations are becoming stricter in enforcement, so “not knowing” isn’t a valid excuse.

Manual Fix:

If you’re not ready for automated payroll software solutions, hire an external HR audit firm or legal consultant to review your team classifications quarterly. They can help you define clear contracts and correct any misclassifications before they become liabilities.

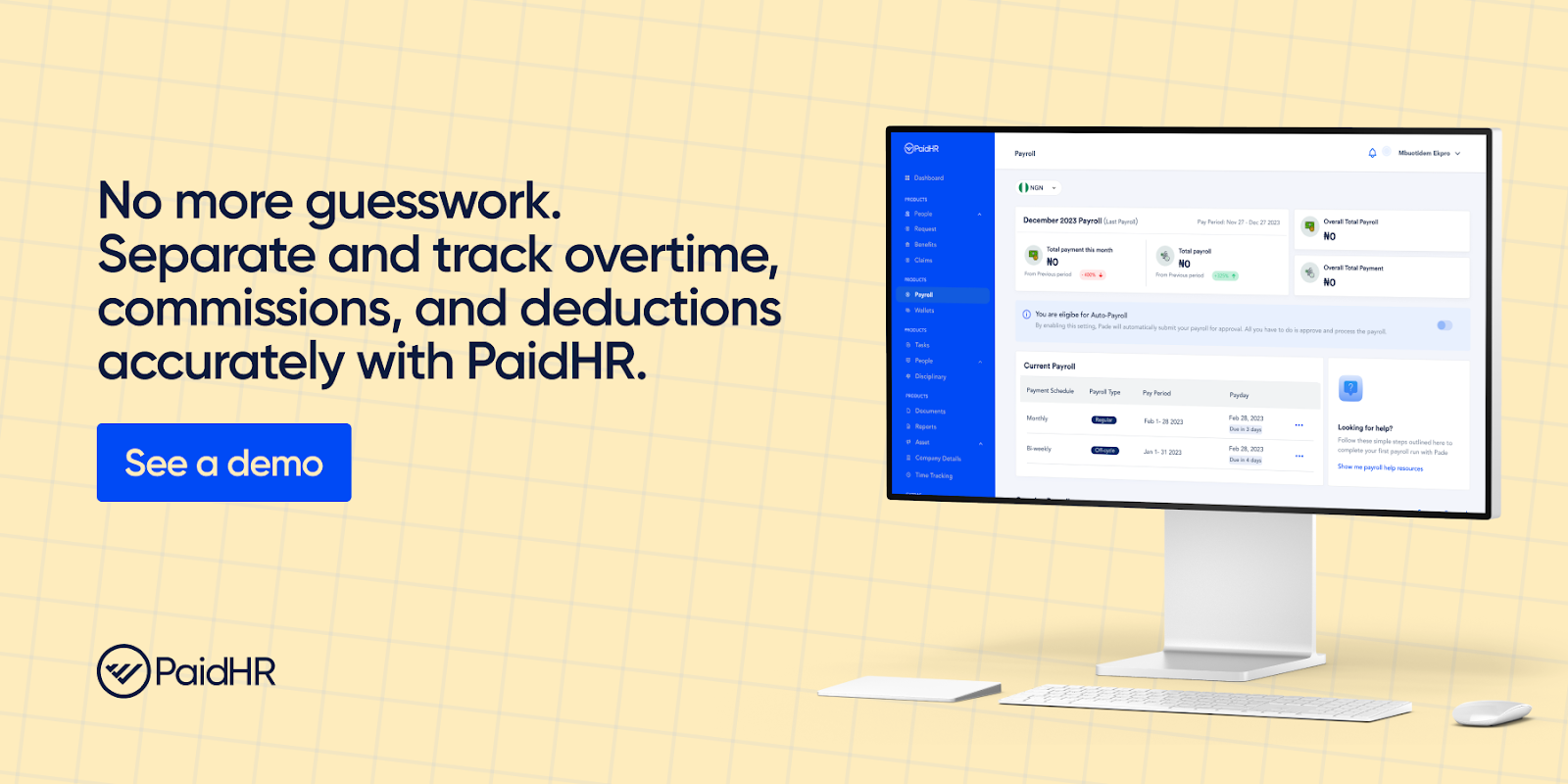

2. Errors in Overtime, Deductions, and Commissions

Startups often rely on informal tracking systems for overtime, leave, and sales commissions. But these numbers directly impact pay, and one mistake can spiral into mistrust, disputes, or overpayments.

What can go wrong:

- Overtime logged on paper or WhatsApp gets forgotten or miscalculated.

- Statutory deductions (like pensions or payroll taxes) are calculated inconsistently.

- Commission structures are unclear or incorrectly applied, leading to under- or overpayment.

Why it’s dangerous:

These errors often go unnoticed until an employee resigns or complains, forcing your startup into a last-minute scramble or payout, sometimes in the hundreds of thousands of naira. This also builds a lack of trust for even future employees.

Manual Fix:

Have an independent accountant or audit firm periodically review startup payroll calculations and commission records. This protects both your team and your startup from future financial surprises.

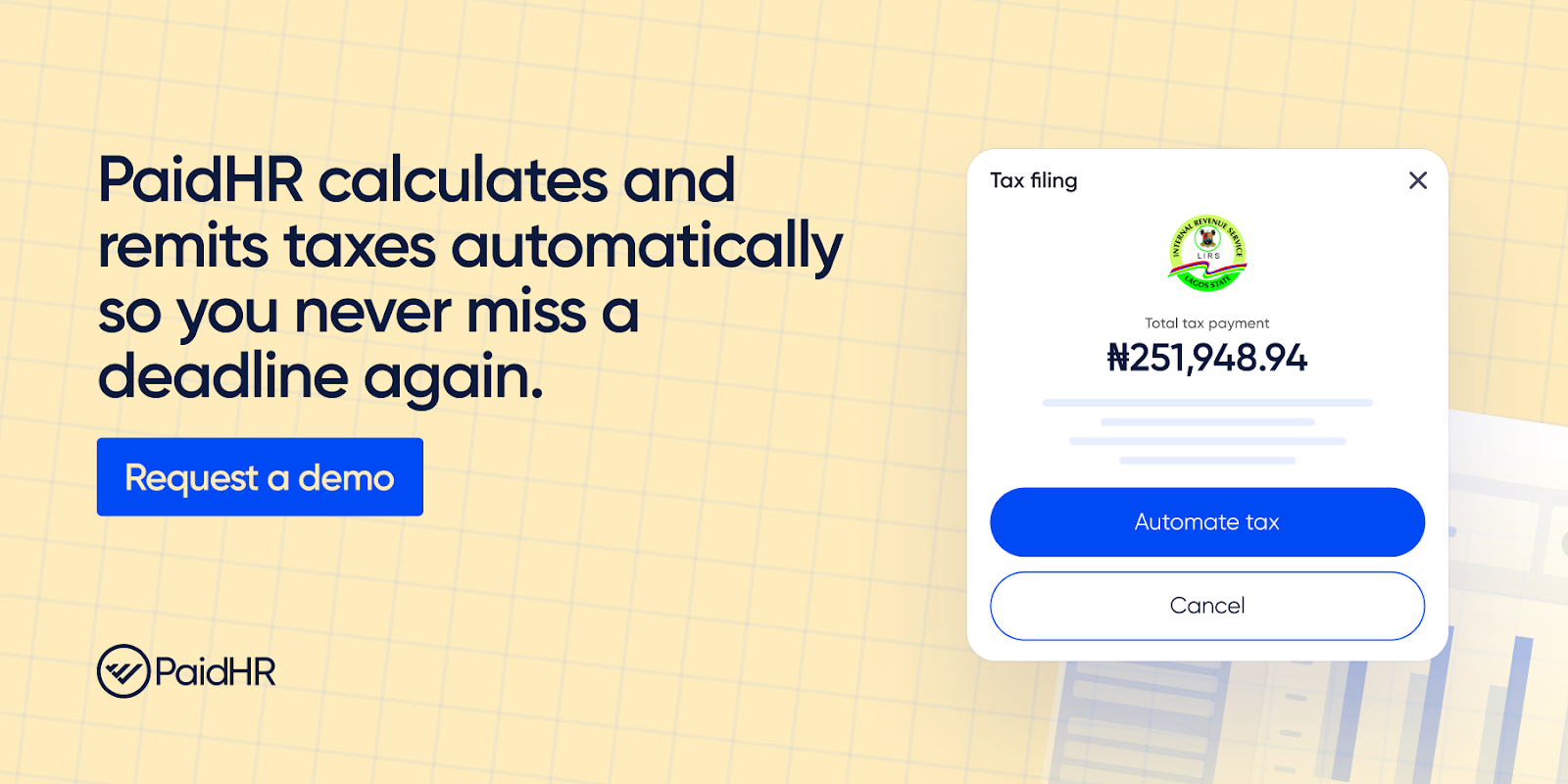

3. Miscalculating and Underpaying Taxes

Payroll taxes like the Pay-As-You-Earn (PAYE), NSITF, pension, the list of statutory remittances in Nigeria is long and can be complicated. Many startups don’t remit the correct amounts, miss deadlines, or don’t remit at all. Read this post to understand how to calculate your taxes.

Common issues:

- Taxes in payroll are calculated based on gross instead of taxable income.

- Payment deadlines are missed.

- The wrong codes or remittance channels are used, leading to penalties from regulators like FIRS or PENCOM.

Why it matters:

Tax bodies in Nigeria are tightening enforcement, and penalties can add up fast, especially for startups trying to prove their legitimacy to investors or regulators.

Manual Fix:

If you’re managing taxes internally, make sure to work closely with a certified tax consultant or audit firm. Have them review calculations monthly, ensure deadlines are met, and create remittance proof files you can fall back on during audits.

Switch to Automated Payroll with PaidHR

While outsourcing reviews to audit firms helps reduce risk, the most sustainable and stress-free solution is to automate your payroll process. That’s where PaidHR comes in.

With PaidHR, you get:

- Built-in tax and deduction calculators that eliminate guesswork.

- Employee vs contractor classification tools aligned with Nigerian laws.

- Integrated leave, attendance, and commission tracking, no manual follow-up.

- Automated payroll and statutory remittances so you never miss a deadline.

Conclusion

Startups don’t fail because of a lack of ambition. They fail when small mistakes like payroll errors pile up and become unmanageable.

If you want to keep managing payroll manually, that’s okay. Just don’t do it alone; bring in a trusted audit firm to help you stay on top of compliance and calculations.

But if you’re ready to save time, reduce risk, and keep your team happy?

PaidHR is the smarter, faster way to run payroll in Nigeria. Book a demo with PaidHR today.